Harpreet Singh, Sub Regional Managing Director, South Asia of Geodis, in an exclusive interview with Freightcomms talking about challenges and contribution of technology in supply chain market

The Asia Pacific Supply Chain Analytics Market size surpassed USD 700 million in 2020 and is anticipated to expand at a CAGR of 15% from 2021 to 2027. In what ways has the Asian supply chain market evolved and which sectors have contributed towards these growth numbers?

The entire logistics landscape is evolving in ways that we might not have ever predicted prior to the pandemic, so much so that we can now expect to experience a very different logistics landscape in the years to come. Asia’s role in global trade, for one, has drastically shifted, with markets actively looking to build more resilient and efficient networks.

The resurgence of many industries – including the rise of super apps in the region as well as the growing demand for healthcare, agritech, and electronic manufacturing services in markets like Singapore – have spurred a concerted effort to strengthen supply chain processes within Asia over these past few years. India, in particular, has been recognised for its great potential to become an alternative production base, especially with more markets looking to diversify their supply chains, creating significant growth opportunities for players within the industry to bolster existing supply chain offerings and infrastructures.

Other efforts have also included the greater integration of shipping and airfreight solutions to support supply chain demands. At GEODIS, for instance, we launched a new intra-Asia Pacific (APAC) flight route, with an established hub in KL that dovetails air services with existing Road Networks to link destinations throughout Southeast Asia. Such multi-modal networks, bridging key markets across Asia, have certainly accelerated the growth of the supply chain industry here.

Looking ahead, many large forwarders, including GEODIS, will be investing in long-term capacity solutions, in addition to operating their own airframes, to service customers’ supply chains efficiently.

What continues to be the biggest challenge with the logistics and supply chain industry today and what measures can this industry take to do things differently?

The uncertainty of the economic landscape can pose risks and challenges within the supply chain industry. For example, the pandemic, inflation, and slowing consumer demand have all impacted the flow of goods and services, triggering many importers across the Pacific to expand and secure a significant amount of inventory space for the second half of 2022.

At the same time, we are seeing further declines in global ocean shipping volumes this year from pre-pandemic levels. Yet, these changes are not unique to the Pacific region alone. We are seeing further declines in global ocean shipping volumes this year from pre-pandemic levels due to pricing changes. The latest Drewry WCI composite index of $3,050 per 40-foot container is now 71% below the peak of $10,377 reached in September 2021. While 19% lower than the 5-year average of $3,754 – indicating a return to more normal prices – it remains 115% higher than the average levels in 2019.

While these can be challenging for logistics players, at GEODIS, we also believe that every challenge is also an opportunity for us to contribute towards shaping the future of the supply chain industry. To address many of these solutions, we have strengthened our services for customers with relevant infrastructure and encouraged them to utilize our multi-modal network offerings for ease of transportation including the Multi-Modal Network and GEODIS Road Network.

It is also crucial for supply chain players to maintain efficient and integrated contract logistics solutions to ensure customers’ needs remain supported despite ongoing shifts in the current landscape. In particular, retail customers, who are still riding on the popularity of online shopping and omnichannel platforms, need logistics operators who can offer the sheer capacity to manage large merchandise inventory, along with the tools to ensure both real-time delivery and visibility.

With India set to become a key hub for logistics in 2023 and beyond, GEODIS has continued to develop solutions like its multi-user facility at the LOGOS Logistics Estate in Luhari – which offers end-to-end contract logistics services to complement our capabilities in freight forwarding – to remain a growth partner to our pan-India customers throughout these changes.

After the Covid-19 crises do you think the dependence on China is reduced? What do you think is an emerging market to compete with Chinese products?

China is a large market, and we expect demand to remain strong in this respect. At the same time, we are seeing many East Asian companies starting to re-establish other markets within the region as distribution hubs to buffer against disruptions, creating massive opportunities for market across Asia. India, for one, with its quick turnaround time and strategic location, has become a favored location for firms looking to rebuild their value chains, following the disruptions caused by the pandemic.

We believe that the potential for Asia is not for markets to compete but rather to work together to bolster the intra-Asia trade flow. For us at GEODIS, we provide customers in India with integrated contract logistics solutions that includes freight forwarding to ultimately accelerate this flow of goods with intra-APAC. This is also supported by flight routes and road transportation across other Asian markets.

The global freight rates are stabilizing and there is a drop in container volumes as well. What are your thoughts on container volume recovery?

While the suspensions of Baltic services of several major liners reduced global capacity for shipments to and from Russia, there will be a moderate improvement in demand on the main legs in trades to and from Northern Europe and the rest of the world. Therefore, it is likely that sea freight rates are going to remain on the higher side of the spectrum, even as we head into 2023. It will take some time for volumes to revert to pre-pandemic numbers, and therefore, an important moment for supply chain players to review and develop innovative multi-modal solutions to better flexible pricing options that cater to different customers’ needs.

Where do you see the technology in the supply chain industry headed over the next several years? Geodis is a market leader in supply chain management and is involved in multiple verticals from retail, e-commerce, pharmaceutical, express transport, and global supply chain, what investments are expected in terms of technology towards the growth of the business and reducing costs of the supply chain?

The pandemic has only pushed us to become even stronger allies for our customers. We have worked closely with them and our partners to identify and develop alternative, yet innovative, transportation solutions that circumvented disruptions, whilst providing the capacity needed to support the surge in e-commerce demand that also came through during this period.

At GEODIS, we are seeing substantial growth opportunities in APAC, with the region expected to lead the growth in the next few years despite the looming economic uncertainty in the US and Europe. China (4.4%), India (6.1%), and ASEAN (4.9%) are set to see a significant increase in their GDP. Therefore, we will continue to invest in IoT, AI, and ML as well as explore other forms of emerging technology that could potentially help us strengthen supply chain infrastructures and networks for the region.

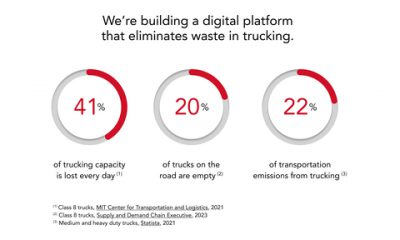

At the same time, we also recognize the need to meet the demand for greener solutions and are taking steps to reduce CO2 emissions by 30% by 2030 (compared with 2017 levels), by ramping up the implementation of low-carbon and carbon-free transport solutions to provide customers with more sustainable logistical solutions. This includes actively looking to develop a holistic plan to tackle decarbonization through coordinated efforts and partnerships with governments as well as R&D institutes to better integrate efficient transport networks, increasing the use of rail, short sea shipping, and inland waterways as well as other multimodal networks to reduce emissions. We are also working to ensure the increased use of energy-efficient fleets to operate on the lowest emissions possible (e.g., electric/hybrids, renewables, biofuels).

Geodis has recently acquired multiple brands globally and also invested in warehouse technology by partnering with technology companies, with these new investments how do you think Geodis is competing with other market leaders?

We have invested in long-term capacity solutions as well as high-tech advancements like IoT, AI, and ML to not only support existing customers but to expand capabilities for new markets and higher-value items to service customers’ supply chains efficiently. This involves creating seamless air, sea and land freight solutions as well as warehouse solutions that help retail partners to manage their inventory with total stock visibility, in addition to processes, like Autonomous Mobile Robots, that make picking and packing more efficient.

Additionally, when it comes to last-mile delivery, logistics players often struggle with finding a delivery fleet robust enough to handle these seasonal surges in orders. To this end, e-commerce platform, UrbanFox, a subsidiary/company of GEODIS, seeks to streamline delivery orders across multiple services, whilst leveraging its unique Last-Mile Delivery model of utilizing crowdsourced delivery drivers to ensure brands are equipped with the resources required to handle surges in parcel volumes.

We believe that these investments have helped consumers receive their goods on time, even as the e-commerce demand continues to grow rapidly. Ultimately, the entire logistics landscape is evolving in ways that we might not have ever predicted prior to the pandemic, and we must be ready to serve our customers in ways that we never thought we had before. With that, we can expect to experience a very different logistics industry and will continue to review investments we can make to allow for the greater integration of shipping and airfreight solutions to support supply chain demands.

It is shopping season as the year is about to end, what preparations and solutions Geodis has taken to navigate the surge in delivering on-time deliveries?

Amidst the Mega Sales Season, our biggest priority is ensuring that our end-to-end logistics ecosystem is robust enough to stay ahead of demand surges and ensure that our customers can get their products on time. Therefore, we have strengthened our services for customers with relevant infrastructure and encouraged them to utilize our multi-modal network offerings for ease of transportation. GEODIS’ own fleet of vehicles and an expanded network of partners enable full and partial loads to be carried by road along the Singapore, Malaysia, Thailand axis, and now Vietnam. The addition of the service will serve businesses driving the manufacturing boom in that country over recent years, helping the region become a vital supply chain node for many high-tech, retail, and FMCG businesses.

Our new multi-user facility at the LOGOS Logistics Estate in Luhari, which opened in March this year, will also supercharge our offerings to clients within the retail sector. With 26,654 sqm of storage space and systems like selective and very narrow aisle (VNA) pallet racks, we are able to effectively address any concerns around space availability and packing efficiency to ramp up order processing during the festive season. The warehouse is also strategically located within close proximity to other large industrial clusters, including Bawal, Bhiwadi, and Dharuhera, as well as the central business districts of Gurugram and Delhi, and the International Airport and National Highway 48, to ensure faster and more reliable delivery options.

This will complement our other region-wide solutions, like the new intra-Asia Pacific (APAC) flight route, with an established hub in KL that will dovetail air services with existing Road Networks to link destinations throughout Southeast Asia. This multi-modal network will bridge Hong Kong, Chennai, Sydney, and Shanghai to KL, and can carry an additional 320 of cargo weekly to support the transportation of goods across the region.

We believe that these solutions will not only buffer against disruptions but also create massive opportunities for Asia’s logistics industry, as we look to see more trade and transportation goods take place within the region.