Customs

The new 2022 edition of the Harmonized System has been accepted

HS 2022, which is the seventh edition of the Harmonized System (HS) nomenclature used for the uniform classification of goods traded internationally all over the world, has been accepted by the all Contracting Parties to the Harmonized System Convention.

Published

4 years agoon

|

Listen to the story (FreightComms AudioPost)

|

HS 2022, which is the seventh edition of the Harmonized System (HS) nomenclature used for the uniform classification of goods traded internationally all over the world, has been accepted by the all Contracting Parties to the Harmonized System Convention. It shall come into force on 1 January 2022.

The HS serves as the basis for Customs tariffs and for the compilation of international trade statistics in 211 economies (of which 158 are Contracting Parties to the HS Convention). The new HS2022 edition makes some major changes to the Harmonized System with a total of 351 sets of amendments covering a wide range of goods moving across borders. Here are some of the highlights:

Adaption to current trade through the recognition of new product streams and addressing environmental and social issues of global concern are the major features of the HS 2022 amendments.

Visibility will be introduced to a number of high profile product streams in the 2022 Edition to recognise the changing trade patterns. Electrical and electronic waste, commonly referred to as e-waste, is one example of a product class which presents significant policy concerns as well as a high value of trade, hence HS 2022 includes specific provisions for its classification to assist countries in their work under the Basel Convention. New provisions for novel tobacco and nicotine based products resulted from the difficulties of the classification of these products, lack of visibility in trade statistics and the very high monetary value of this trade. Unmanned aerial vehicles (UAVs), commonly referred to as drones, also gain their own specific provisions to simplify the classification of these aircraft. Smartphones will gain their own subheading and Note, which will also clarify and confirm the current heading classification of these multifunctional devices.

Major reconfigurations have been undertaken for the subheadings of heading 70.19 for glass fibres and articles thereof and for heading 84.62 for metal forming machinery. These changes recognize that the current subheadings do not adequately represent the technological advances in these sectors, leaving a lack of trade statistics important to the industries and potential classification difficulties.

One area which is a focus for the future is the classification of multi-purpose intermediate assemblies. However, one very important example of such a product has already been addressed in HS 2022. Flat panel display modules will be classified as a product in their own right which will simplify classification of these modules by removing the need to identify final use. Health and safety has also featured in the changes. The recognition of the dangers of delays in the deployment of tools for the rapid diagnosis of infectious diseases in outbreaks has led to changes to the provisions for such diagnostic kits to simplify classification. New provisions for placebos and clinical trial kits for medical research to enable classification without information on the ingredients in a placebos will assist in facilitating cross-border medical research. Cell cultures and cell therapy are among the product classes that have gained new and specific provisions. On a human security level, a number of new provisions specifically provide for various dual use items. These range from toxins to laboratory equipment.

Protection of society and the fight against terrorism are increasingly important roles for Customs. Many new subheadings have been created for dual use goods that could be diverted for unauthorized use, such as radioactive materials and biological safety cabinets, as well as for items required for the construction of improvised explosive devices, such as detonators.

Goods specifically controlled under various Conventions have also been updated. The HS 2022 Edition introduces new subheadings for specific chemicals controlled under the Chemical Weapons Convention (CWC), for certain hazardous chemicals controlled under the Rotterdam Convention and for certain persistent organic pollutants (POPs) controlled under the Stockholm Convention. Furthermore, at the request of the International Narcotics Control Board (INCB), new subheadings have been introduced for the monitoring and control of fentanyls and their derivatives as well as two fentanyl precursors. Major changes, including new heading Note 4 to Section VI and new heading 38.27, have been introduced for gases controlled under the Kigali Amendment of the Montreal Protocol.

The changes are not confined to creating new specific provisions for various goods. The amendments also include clarification of texts to ensure uniform application of the nomenclature. For example, there are changes for the clarification and alignment between French and English of the appropriate way to measure wood in the rough for the purposes of subheadings under heading 44.03.

Given the wide scope of the changes, there are many important changes not mentioned in this short introduction. All interested parties are encourage to read the Recommendation carefully (to be published soon).

Implementation

While January 2022 may seem far off, a lot of work needs to be done at WCO, national and regional levels for the timely implementation of the new HS edition. The WCO is currently working on the development of requisite correlation tables between the current 2017 and the new edition of the HS, and on updating the HS publications, such as the Explanatory Notes, the Classification Opinions, the Alphabetical Index and the HS online database.

Customs administrations and regional economic communities have a huge task to ensure timely implementation of the 2022 HS Edition, as required by the HS Convention. They are therefore encouraged to begin the process of preparing for the implementation of HS 2022 in their national Customs tariff or statistical nomenclatures. The WCO will step up its capacity building efforts to assist Members with their implementation.

You may like

-

Tow-away regulations in Rotterdam for incorrectly moored barges

-

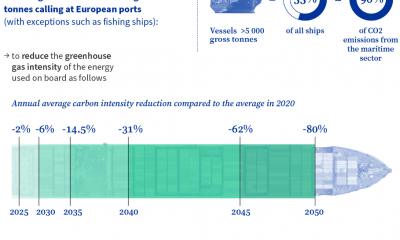

EU member states agree to the “FuelEU Maritime” regulation

-

Dronamics is first cargo drone airline with IATA and ICAO designator codes

-

DNV to launch a Recommended Practice for vessel technical performance

-

DP World and Standard Bank partner to expand trade finance in Africa

-

INTERCARGO reaches membership milestone

Customs

How to select and manage your customs broker effectively?

Published

2 years agoon

July 12, 2022

|

Listen to the story (FreightComms AudioPost)

|

How to select and manage your customs broker effectively? For many companies that conduct cross-border supply chain activities, customs clearance can be a major headache if not handled correctly, given that each customs transaction is essentially a statutory declaration to the government.

False or incorrect customs declarations carry legal liabilities for the exporter, importer, and the broker, which can lead to possible penalties that include heavy fines, suspension of business license, seizure of cargo or even criminal charges. Not to mention, damage to a company’s brand and reputation. To help organizations select the right customs brokerage vendor, the following seven-step process is recommended.

How to select and manage your customs broker effectively? Image – Geodis

Step 1: Precision & Accuracy in the Scope of Work

One of the biggest errors in outsourcing is the lack of clarity that surfaces when companies are providing business requirements in the scope of work. Also, it is common to see a big disconnect between the headquarters and the local offices in different countries during vendor selection, which is why representation from local teams is necessary in cross-border projects. To enable vendors to execute projects successfully, it is imperative to specify clearly all information pertaining to organization’s business requirements as well as the performance metrics. This document should include:

- Geographical coverage – Which markets/cities are covered? Are there specific port locations?

- Product types – Specify the type of products as well as their HS codes.

- Estimated volume projection – Provide estimated volume on import and export under different types of transportation modes, as well as different types of clearance formalities, such as those involving Export Processing Zones (EPZ), Free-Trade Zones (FTZ), bonded warehouses, in-land transits.

- Any special customs services may be required – State any services that require special attention. These may include temporary import and export, ATA CARNET, customs inspection, Other Government Agencies (OGA) declaration, import or export permit application, advance ruling application, FTA duty concession, duty drawback, and export control.

- Operating hours – State the regular operating hours required of customs brokerage vendor, even if it’s 24×7.

- Electronic customs integration – Ensure that customs transactions are carried out electronically to speed up the process with minimum human intervention. It also benefits companies as they can receive real-time updates on the entire customs clearance process.

- Reporting requirements – Specify the frequency and format of reports (daily/weekly/monthly).

- Other value-added services – State all other needs required, such as duty & tax advance payment, customs control tower, HS code classification, duty & tax optimization, staff training, or post-clearance audit.

- Performance metrics – Make sure companies establish measurements for success. These should include the pre-clearance and error rates, percentage of shipments cleared within 48/72 hours, percentage of green lane clearance etc.

- Record retention requirements – Specify the type of storage (electronic vs hardcopy) and period of retention.

Step 2: Ethics & Rules of Engagement

Clear and concise rules of engagement are necessary to outline the flow of communication between the broker and the customer covering different operating scenarios, including having a deviation recovery plan should there be any customs delays. As such, it is absolutely critical to outline a supplier code of conduct for all customs vendors to adhere to the ethical standards of the company. These should include:

- Integrity, ethics, and conduct (e.g., anti-corruption)

- Corporate governance (e.g., accountability & transparency, data protection)

- Labor and human rights (e.g., anti-slavery, diversity, and equality)

- Health and safety (e.g., providing a safe and healthy workplace)

- Environmental management (e.g., carbon footprint reduction)

Step 3: Broker Selection

Broker selection is often based mainly on pricing which unfortunately means that a lot of the times companies choose less established brokers who are not able to provide strong process control and robust IT infrastructure. Which can lead to lower level of regulatory compliance in the end. While choosing the right vendor, companies should base their decision on other critical factors like:

- Product Line for Customs Clearance- Not all customs brokers have the experience and expertise to handle all types of product lines, companies should consider using a customs broker that has the experience and expertise to handle products in specialized verticals, such as oil & gas, pharmaceutical, chemical, aerospace, and food & beverage. These types of cargo require in-depth knowledge to ensure smooth clearance due to additional regulatory controls from Other Government Agency (OGA).

- Track Record of the Broker- Customs authorities in many countries have already implemented Authorized Economic Operator (AEO) certification on all supply chain players, including customs brokers. Companies should do their due diligence by performing background checks to ensure that they only appoint AEO-certified customs brokers who have a good standing and clean track record without any prior customs violations.

- IT Capabilities – With the ongoing global supply chain volatility, it is more important than ever that customs brokers offer real-time visibility and electronic data-interchange so that companies are informed of any changes or incidents as-they-happen and are able to respond swiftly. Equally important is to make sure that the company’s appointed customs broker is well-equipped with robust IT security to prevent cyber-attacks, malwares and other disruptions by hackers.

- Global Reach – For companies that operate in different continents, an international customs brokerage service provider with global reach is essential. The established provider is able to ensure service level consistency, seamless data transfer, single window contact point, global view reporting and regulatory updates with robust compliance control.

- Management Commitment to Customs Brokerage Services – It is common for freight forwarders to provide customs brokerage services on top of freight services. For large companies looking to secure long-term partnerships with these freight forwarders, it is critical to assess their level of commitment to customs brokerage services. Common indicators of this commitment can be:

- Having a dedicated global and regional leadership in customs and trade compliance management

- Having their top talents in the customs brokerage team

- Continuous investments in IT infrastructure for customs operations

- Collaborations with customs authorities

- Providing regular training & development opportunities for their brokerage team

Step 4: Contractual Agreement

Make sure the business requirements and deliverables – including service level agreements, agreed pricing rates and timelines, and detailed terms and conditions – are clearly written in the contract. Given that there is usually a long lead time for onboarding a new customs broker, companies should consider establishing a fair and equitable deal for both parties. This helps with avoiding the impression that the terms and conditions favor one party over the other – something which inevitably creates friction and instability in the business relationship later on.

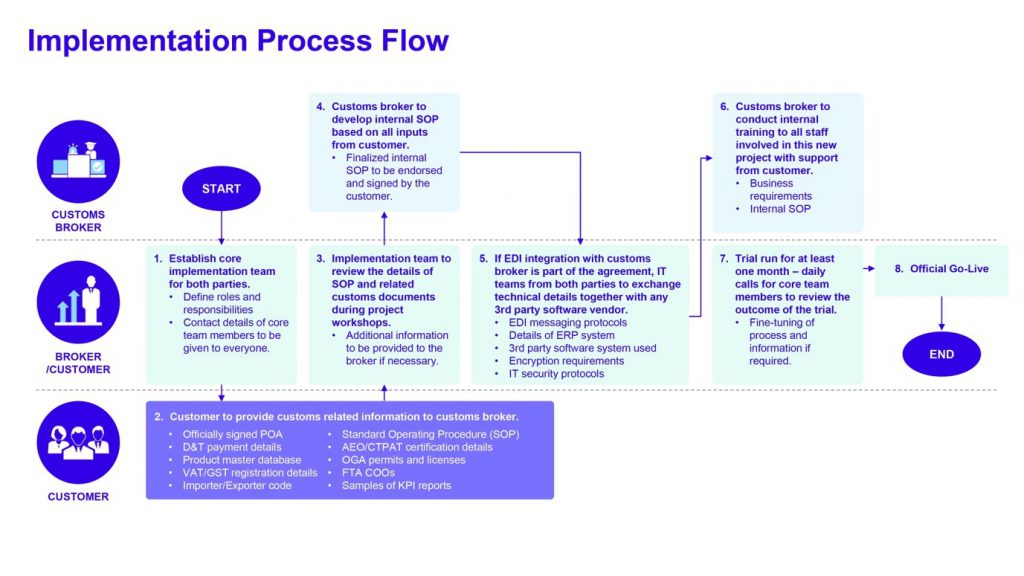

Step 5: Implementation & Execution

Onboarding a new customs broker can be challenging if it is not well-planned. Consider this high-level workflow of a successful implementation plan after selecting a new broker:

How to select and manage your customs broker effectively? Image – Geodis

Step 6: Performance Monitoring

Having an effective and structured performance management process in place will help companies not only to measure and analyze how well the vendor is doing, but also to ensure that the company is regularly assessing their service levels, costs, and compliance practices. The following are some of the best practices on vendor performance monitoring:

- What a company scorecard should include – A company’s performance scorecard should include all relevant KPIs that align with its business objectives. Other than customs-related performance metrics, also include other operational KPIs, such as response to escalation, invoicing accuracy, and timeliness.

- Conduct regular reviews-Regular business review meetings – preferably conducted monthly during the first six months of any new project, with the customs broker to ensure everything is under control. Work together to identify opportunities for further improvement. The frequency of these meetings can be reduced to quarterly discussions if the vendor is meeting contractual expectations.

- Corrective action plans –When things go wrong, request a corrective action plan immediately to ensure that there is no repeat of similar errors.

- Onsite audits-Annual onsite audits of the vendor’s premises are a necessary part of the company’s regulatory compliance management. This gives companies an opportunity to check on other aspects of their operations, and to ensure that they are conforming to expected ethical and corporate governance requirements.

Step 7: End of Contract or Renewal

When the customs brokerage contract is expiring, companies can decide to renew or end the contract according to the agreed terms and conditions. This is a good opportunity to assess the contract against industry guidance and make any necessary amendments. Here are a few points to consider before making a final decision on renewing a contract:

- Lead time to plan ahead

Always plan ahead on contract review for the existing customs brokerage subcontracting activities. At least six to nine months of preparation is required in view of commercial negotiation, internal legal review, and approval process for both parties. - Making a comprehensive review – Although pricing is one of the major considerations in any contract renewal with an existing supplier, it is critical to also look at other major aspects of the customs brokerage performance. These include regulatory compliance, mistakes and violations, exception handling, flexibility, and overall relationship.

- Understand the market – Conduct market research to see if there are other suppliers that can provide even better service at similar or lower pricing.

- Refining the Service Level Agreement (SLA)- This could be warranted due to changes in a company’s operating model, changes in the regulatory environment, or the organization’s goal of setting higher requirements as part of continuous improvement.

Conclusion

Having a solid compliance model in place is critical for any successful company that is looking at international trade. The role of a top-tier customs brokerage vendor that provides high-quality service with uncompromising regulatory compliance and excellence in customer experience simply cannot be overstated. Companies often place an excessive amount of focus on pricing, making it their leading factor for choosing the right vendor only to realize that the cost of the damage done by weak compliance can be much higher, in the end. It is important to give multiple factors equal weightage while choosing the vendor.

Another issue that large enterprises often face is the fact that the local subsidiaries (particularly in developing markets) often do not have access to more experienced brokers which have a global reach. Furthermore, employees at these local subsidiaries may not be fully aware of the importance of data security or customs and trade compliance. So, their reliance on professional, global brokers is even higher. As a result, if they do not find an experienced vendor with the required know-how and capabilities, companies are at a higher risk of any regulatory violations due to an overseas subsidiary or supplier lacking the correct knowledge and infrastructure. The result being sizeable negative repercussions for the company.

While planning for any overseas ventures, it is non-negotiable to have an experienced, reputed and well-equipped customs brokerage partner and a tried-tested and seamless process of onboarding and engaging with the vendor. The resources dedicated to developing company-wide best practices for regulatory compliance pay huge dividends to companies in the long term as they unlock more growth opportunities for them, in a world that is becoming smaller and more connected thanks to technology.

Customs

Descartes acquires NetCHB to strengthens ecommerce customs filing

Published

2 years agoon

February 10, 2022

|

Listen to the story (FreightComms AudioPost)

|

Descartes Systems Group, the global leader in uniting logistics-intensive businesses in commerce, announced that it has acquired NetCHB, a leading provider of customs filing solutions in the US.

NetCHB has been helping its customers streamline and automate customs filing processes in the US for more than 15 years. The company’s cloud-based platform is used by more than 700 customs brokers to connect to the US Customs and Border Protection Automated Broker Interface to electronically execute both fiscal customs declarations and security filings. More recently, the company has built on its success with traditional customs filings to capitalize on changes in the regulatory filing framework for Section 321 Type 86 ecommerce shipments. Section 321 Type 86 is a voluntary filing initiative for low-value ecommerce goods that CBP introduced in 2019 to streamline border crossing.

“Section 321 Type 86 compliance is complex, but brokers and forwarders that take advantage of it can reduce the amount of time ecommerce packages are waiting for customs release,” said Ken Wood, EVP Product Management at Descartes. “NetCHB’s platform automates the declaration process for high volumes of ecommerce shipments and helps keep them moving quickly to consumers, helping some of the largest ecommerce customs brokers and forwarders process shipments in a compliant and efficient manner.”

“As the digitization of the logistics and supply chain industry picks up pace, we continue invest in complementary solutions that add depth and breadth to our Global Logistics Network,” said Edward J. Ryan, Descartes’ CEO. “NetCHB has a team of deep customs domain experts, scalable and robust technology solutions, and a large group of customers that will benefit from additional solutions available on the GLN to help them manage the lifecycle of shipments.”

NetCHB is headquartered in Arizona. Descartes acquired NetCHB for up-front cash consideration of $40 million, plus potential performance-based consideration. The maximum amount payable under the all-cash performance-based earn-out is $60.0 million, based on NetCHB achieving revenue-based targets over the first two years post-acquisition.

Customs

DP World launches CARGOES customs: a single window digital solution for border authorities

Published

2 years agoon

January 20, 2022

|

Listen to the story (FreightComms AudioPost)

|

DP World, the leading global logistics company and provider of smart supply chain solutions, announced the launch of its new digital compliance and revenue platform, CARGOES Customs. The platform facilitates completely paperless trade easing the flow of the customs process using innovative technology solutions, including an Artificial Intelligence driven risk engine and smart valuation. Its advanced classification wizard, based on machine learning, vastly reduces classification issues. It is designed and supported by customs experts and digital transformation leaders, and is backed by more than 40 years of experience in logistics to solve challenges in the supply chain.

CARGOES Customs provides an intelligence-enabled, unified customs operating model that optimizes border management and revenue collection activities. The system empowers customs agencies to facilitate trade, secure global supply chains, and increase compliance. At the same time, it minimizes revenue leakage for government agencies. The platform is built to assist global customs organizations in reforming and modernizing processes by streamlining digital transformation through the latest technology and tools.

The CARGOES Customs platform is based on the belief that with technology as a foundation, any customs organization can vastly improve its digital capabilities and better integrate with key agencies and other countries, while also satisfying any regional agreements. The CARGOES Customs system is further enhanced by its powerful risk engine which detects revenue leakages. This technology improves visibility and traceability, and is based on WCO best practices, thereby optimising the customs clearance process. As an intelligent risk engine, it helps enforce compliance and promotes seamless collaboration between authorities, government departments and stakeholders.

Offering a single window interface, CARGOES Customs is highly configurable and uses a template-based design which means customs organizations can update or roll-out new services at the click of a button. It supports all file formats commonly used in customs, and is WCO, WTO and SAFE framework compliant.

Sultan Ahmed bin Sulayem, Group Chairman and Chief Executive Officer of DP World said: “Trade is a key driver to help economies around the world to recover fairly and sustainably from the economic shock of the pandemic. At DP World, we are doing our part to make trade flow as smoothly and seamlessly as possible, and with CARGOES Customs we really help customs authorities around the world to become dramatically more efficient – now and for the long term. This new digital solution connects customs officials and traders through an easy-to-use interface and a suite of custom-built tools. We will continue to invest in our digital platforms to bring simplicity, transparency and efficiency to global trade – at customs, and beyond.”

Pradeep Desai, Chief Technology Officer, DP World concluded: “Demand for digital solutions has never been higher and will only keep growing. We are leveraging technology to create value for our customers and help drive growth. CARGOES Customs by DP World is part of the broader CARGOES software suite of products. DP World created CARGOES to solve pressing challenges caused by supply chain related inefficiencies. It’s a holistic solution powered by technology targeting all aspects of global trade including Finance, ERP, Tracking, Terminal Operating System, Customs software and enabling end-to-end logistics. We are excited to provide Logistics as one of our first CARGOES offerings to customers.”

Search

The Port of Valencia begins electrification of its docks

Ryder establishes Baton, a Ryder Technology Lab, based in Silicon Valley